Simple (13)

I'm on this never-ending quest to simplify my life as much as possible--so hooking up the Facebook/Twitter connection brought me one step closer to that goal.

To do this, just visit http://apps.facebook.com/twitter/ , log in if needed, and click on your profile and any other Pages you have when it asks you to allow Twitter to post updates to them. Easy-breezy!

Now, if there was only an app to allow Facebook to do my laundry... (app-masters, get on that stat!)

---------------------------------------------------

About the Blogger:

Vonetta Booker-Brown is the creator of SuccessTales.com, a resource/membership site for savvy female small business owners--and the author of the e-book Success Tales: Female Entrepreneurs' Stories of Challenges, Inspiration & Success--featuring BBWO's own LaShanda Henry!

One of the biggest challenges that Small Businesses face is creating effective marketing collateral. In addition to a challenging budget, there is just the question of what to communicate. My motto is K.I.S.S., Keep It Seriously Simple! Don't make the mistake of over communicating your product or services. Consumers are a lot smarter than you think, but they don't want to be bombarded with tons of messaging or content. It takes too much time to sift through the clutter. So in order to help you avoid overkill, I will offer you some Tips in Marketing K.I.S.S.

1. Avoid Hokey Taglines - If you can't afford to hire a marketing consultant, then leave off the tagline all together. As cleaver as you might think you are, customers can always tell when your tagline is homegrown.

2. Get to the Point - Don't waste time with too many details on your materials. Your collateral should communicate four things immediately. 1) Who you are, 2) What you do, 3) What is unique about your offering and 4) How to contact you. Anything more is TMI (too much information).

3. Minimize Images - Too many images can be a lot of the brain to process. Keep your collateral to 1 or 2 images that communicate your focus at a glance. If you need to show multiple images, then stick to one main image that draws the focus. Keep the other images subordinate so they con't compete with the main focus.

4. Use the 3-Click Rule - When it comes to your website or blog be sure not to bury your content and confuse visitors. The 3-Click Rule states that a visitor should be able to get to any content on your site within 3 clicks. Does your site measure up?

5. Eliminate Business Card Clutter - While your business card has a lot of 'real estate', its important to stage the content carefully. Stick to relevant contact details on the front, such as your name, title, email address and phone number. Put all other details on the back (but don't make the mistake of printing a book back there).

There are lots of other ways to Keep It Seriously Simple, but its easiest just to keep the customer in mind by asking a simple question. If I had 5 seconds what would I want my customers to know? I have included a sample ad that we designed for a customer utilizing Marketing K.I.S.S.

Happy Branding!

You can continue this conversation on Twitter @brandcoachllc or on Facebook.com/TheBrandCoach

If you are a self-employed individual or running a small business, check out 7 quick things you need to do BEFORE or by January 31, 2011 to stay in good graces with the IRS!

1. ISSUE 1099s - If you hired an independent contractor in 2010 or worked with a non incorporated business, you must issue 1099 by January 31, 2011. You still have until February 28 to actually report to the IRS giving time for any corrections, however you should ensure your contractors and vendors have received their 1099 by the 31st.

2. ISSUE W-2s - Did you hire any employees in 2010? Even part-time? Seasonal? Aside from ensuring you did apply for employer tax numbers, you should also ensure you submit your employees (even terminated ones) W-2s by the 31st. If you use a payroll service, check with them to ensure your payroll records are accurate and complete before issuing W-2s.

It's the start of the new year which for many of us means new beginnings, resolutions and planning for tax season. Some of us are looking for a "do over" and want to start this year off on a better foot regarding our finances. I know BEEN THERE!

Well for many micro businesses whose personal life and business life blur starting over can be frustrating and intimidating. I have 3 quick tips to help you restart your Micro Business for 2011 with a simple mindset change:

1. Hire an Accountant! - I know of course an accountant will say that but it's TRUE! Knowing the importance of having a professional at your findertips is very important. Remember, accountants work year-round not just between January - April. In fact most accountants and CPAs are busier in the off-tax season months helping clients SAVE MONEY, Tax plan, strategic planning and more! Ours is always on speed dial ;-)

So what is this about?

Well my company Your Simple Bookkeeper,is a bookkeeping company focused on Micro business owners just like youthat need accessible, affordable yet high quality bookkeepingservices.We seek to close the gap between the heavily under-served microbusiness owner (most businesses under $500,000 in annual revenue) andquality real-time accounting services. We do this by offeringBookkeeping Support Services starting from $35 - $150 per month. It's anambitious proposition we know but as a micro business, we truly believethat the Micro business is the true back-bone of the "small business"and the country.

So what about this Contest?

The Contest is rather simple. We're asking you to help us spread the word about our unique Micro Business service model by:

- Tweeting about us (using #ysbcontest and @yoursimpletweet)

- Sharing the contest with your peers

- Joining our Facebook page

- Suggesting our facebook page to your friends

- Joining our community or mailing list

- Or any other creative way you can think to help us spread the word

We'll be picking one luckybusiness every month between October and March 2011. We'll also bepicking one 2nd place winners every month and FREE Tax Review servicesand discounted bookkeeping services available to everyone just forentering! There is no obligation to hire us for ongoing bookkeepingservices after we clean your books (although why wouldn't you?)

I'mexcited about this contest because I know it will change the way manyof you look at managing your books within your business. They aim is tohelp you stay in business. By helping you start the New Year off right with a clean mind mind and clean set of books. Whew, just the thought makes me feel better, don't you?

Click the links above or here to learn more and enter. Good Luck!

Every Wednesday from 2-4pm EST I am on my website live discussing ANY business and accounting topic you may have. Now no need to worry about your accountant billing $150 an hour just to ask a simple question! The first 30 mins features your's truly LIVE broadcast where for about 20-25 minutes I discuss a specific topic and for the remainder of the time I leave my chat lines open to discuss the topic at hand or any other questions you may have. If the question is too complex to answer via chat, I'll request your email or other means of communication and we chat off line (and I won't bill you).

For the next couple weeks we are exploring business entities and the benefits of each one. I also offer some little known benefits as well as offer simple explanation of complex idea.

- What business entity did you choose for your business?

- Why did you choose it?

- Do you know if you are receiving the best Tax benefit from it?

Join me LIVE today at 2pm by clicking here! I can't wait to chat with you!

P.S. If you miss this opportunity, no problem, I post the entire broadcast on my website. I also post smaller highlights as well.

Today I wrote on my website about the current TAX AMNESTY program taking place in Washington, DC and how residents there can take advantage of it. Not sure what a Tax Amnesty is? Basically it's when your states department of revenue either reduces or completely eliminates penalties and fines incurred when you failed to file and pay your taxes. States do this as a way to bring citizens in compliance as well as to raise revenue (DC expects to raise $20 million from their program)

How do they raise money? Simple, oftentimes what may stop you from paying taxes once you realize you owe is the penalties and fines imposed and the high cost of hiring a tax firm to help negotiate a lower rate is a hefty expense as well. The government has to spend money hiring auditors, initiating garnishments, and the sort. When many states are faced with tight budgets and low revenues, offering a Tax Amnesty to abate outstanding tax penalties is the answer they need.

Check out the full article here and while you're there, join our Small business community, or check out our latest Live Broadcast Video archive.

As always, Be Empowered,

-Katrina

One of my favorite websites for business and entrepreneurship is Inc.com (if you haven't been to this site and you're in business check it out!) Today I got the perfect I mean PERFECT alert regarding business and taxes and I want to share with you the highlights!

The article discusses planning for the next tax season now by being PROACTIVE. In essence, what this means is not waiting UNTIL January 2011 or April 14th for that matter to giving attention to your businesses finances. It means taking small steps through out the year to manage and organize your books, ask questions to your Tax Preparer or Tax Advisors, knowing and understanding the new tax law changes and how they affect your business today and so on. Several tax professionals offer their advice and tips on this and have formulated it into an acroymn: P.L.A.N.

P. Preparing your Records

L. Listing Issues and Questions

A. Analyizing for Accuracy

N. Noting Changes in Tax Laws

Do you P.L.A.N for your taxes? As a Bookkeeper and Small Business consultant, I realize that most if not ALL of these steps can be time consuming or frustrating when you don't know where to begin. Especially noting changes in Tax Laws. Unless you're like me and receive IRS updates and alerts daily most businesses find navigating through the text to find relevant information they can apply today elusive, confusing and just a waste of precious money producing time. I get it!

Some small businesses do hire Bookkeepers to take on this task which is highly recommended, but small businesses are made up of roughly 78% Micro businesses who most simply cannot afford to do this! While I LOVE this article, it does very little in directing business owners on where to begin to Plan for tax time. I consult with or talk to many business owners weekly who have this very issue, "where do I begin, and where do I find the time, how can I afford a bookkeeper?" When you don't feel you can afford a bookkeeper, what do you do?

No this isn't a sales pitch, but there are ways you can get the help of a qualified bookkeeper to get your records and books in order before tax time. Some will help you and provide you with tools if you choose to do it yourself completely free or for a nominal monthly fee. Depending on your budget you may be able to afford an outsourced bookkeeper to help you manage your books. Affordable BOOKKEEPING for your business DOES EXIST if you know where to look! I urge all businesses micro or small to take the time to consult a Bookkeeper at the minimum or CPA to request a review of your books and recommendations for how to P.L.A.N. for tax time. In my blog about Proactive Accounting, I talk about how planning in advance can actually SAVE you money at tax time, and save your business!

Take the time to call your local bookkeeper or CPA, invest a couple hundred dollars and request a review, be Proactive about your business! If you are having difficulty in finding a bookkeeper, give me a call, inbox me. Even better become a fan of YourSimple Bookkeeper, Inc. on Facebook and I'll put you on my priority list for the launch of my YourSimple Bookkeeper -in-a-Box Download on Effective Recordkeeping which is available for Free download Tuesday July 6th (and forever and ever and ever after that)! Information is free in my mind.

Remember: Making Money is EASY, Keeping it is where the Challenge comes.

To check out the full Inc.com article click here.

To become a fan of YourSimple Bookkeeper to be one of the first to receive a FREE download click here.

Host a June party and earn products for your OWN backyard bash!

Host rewards:

- Have a $500 party: Get our Backyard Basics Collection!

- Have a $900 party: Get our Servin’ Up Sunshine Collection!

- Have a $1,500 party: Get both collections!

You’ll also be entered in our Birthday Call Sweepstakes to win $115 in Tastefully Simple products!*

Parties must be held June 1 – 30, 2010. Ask me for details!

*Answer your phone saying ‘Happy Birthday Tastefully Simple!’ during your party when they call you.

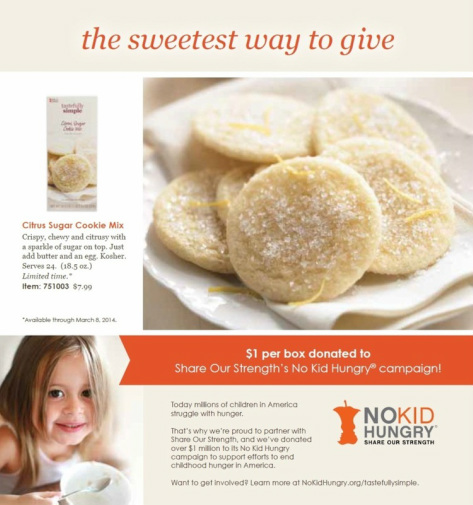

Tastefully Simple’s Fall/Winter product line is coming to an END! Stock up NOW on your favorites! Once they leave on March 7th- there is NO GUARANTEE they will ever return!

Order 3 or more F/W Products before March 5th and receive $1 off each OR a FREE Bountiful Beer Bread ($5 value). Call Kimberlee Stevenson at tastefullykims@gmail.com to place you order!

Book your SPRING party with me by March 5th and receive a FREE Drink Mix! (a $10 value) Call me to pick a date!

Everybody’s Chili Mix

Bowtie Pasta & Chicken Cacciatore Mix

Hearty Chicken & Dumpling Soup Mix

Creamy Wild Rice Soup Mix

Pasta & Portabella Beef Stroganoff Mix

Oven Baked Mac & Cheese Mix

Italian Garlic Bread Seasoning

Oh So Olive Dip Mix

Bruschetta Cheese Ball Mix

Cheese It Up! Crisps

Cheesy Chive Warm Dip Mix

Sesame Teriyaki Stir-Fry Sauce

Roasted Garlic & Herb Dip Mix

Sweet Bell Pepper Dip Mix

Gotta Lotta Garlic Salsa

Ruby Orange Slush Drink Mix

Berry Sunrise Raspberry Syrup

Berry Sunrise Raspberry Pancake & Waffle Mix

Carrot Pecan Bread

Awesome Amaretto Cocoa Mix

Warm Up! Mulling Spice

Creamy Dreamy Chocolate Mousse Mix

Apple Crisp Cheese Ball Mix

Easy Slow Cooker Recipes Booklet

Seedless Black Raspberry Preserves

Oh, So Berry Granola Snack Mix

Nutty Good Granola Snack Mix

Cranberry Tangerine Cheesecake Mix with Spiced Graham Cracker Crust Mix